The most core and basic of all human nature is self-interest. This is the nature we are all born with. Every baby cries to be fed or changed. One of the first words we all learn as infants is “MINE!”

On the other hand, sharing is an unnatural, taught behavior. Teaching a youngster to share is one of the most important missions of good parenting, but that taught behavior only overlays our core more basic selfish nature, which is always still there at our core. Sharing never actually replaces that most basic component of our nature.

Altruism is a rare virtue at best, and no matter how well-intended putting others before ourselves may be, concern for others never truly replaces the most basic self-interested component of our nature.

Virtue signaling is vastly more common than human virtue is.

Though they are frequent virtue signalers, the super wealthy financiers of this world did not get to where they are because they are virtuous, selfless or altruistic people.

Since the Second World War, the commerce of modern society has become very complicated. The rise of national and international level commercial trading has produced huge markets in which the nation’s goods and services are bought and sold on a wholesale basis.

Since the Second World War, the commerce of modern society has become very complicated. The rise of national and international level commercial trading has produced huge markets in which the nation’s goods and services are bought and sold on a wholesale basis.

Despite the fact that the Lords of Finance reside and work on Wall Street, and all the other Walls Streets of the World, in London, Paris, Berlin, Switzerland, Tokyo, Dubai, etcetera the poster child of these globalist financier influencers is Charles Schwab, the founder of the World Economic Forum, which hosts its annual January meeting, in Davos, Switzerland. These well heeled financier power elites, their political operatives and invited influential politicians, and honored celebrity spokespersons all gather there, and they plan and discuss the trends and fate of the commercial world they control. In all fairness Mr. Schwab espouses responsible stakeholder capitalism rhetorically, but few of the annual attendees actually put those ideas into practice.

The most disturbing thing from the perspective of the regular middle class people of the western world, and of America in particular is that over the last fifty plus years these globalists have strongly advocated the off-shoring of manufacturing, and more importantly of the off-shoring of the good paying manufacturing jobs.

During those fifty + years the middle class in the United States has fallen from being a prosperous, and stable 85% of American society who lived comfortably on the good incomes of their often union protected jobs and salaries to becoming the thin remnant of roughly 15 or 20% of American society. By 2000, most of the younger high school and even college graduates entering the job market were being forced to work jobs that paid scantily more than the national minimum wage rate, while they lived their near-subsistence level existences.

The neo-liberal, globalist government supported trade policies greatly favored the power elites, and a phenomenally wealthy group of global monopolist from Wall Street, Silicon Valley and elsewhere became the new super wealthy, while the core of American society on Main Street struggled to make ends meet.

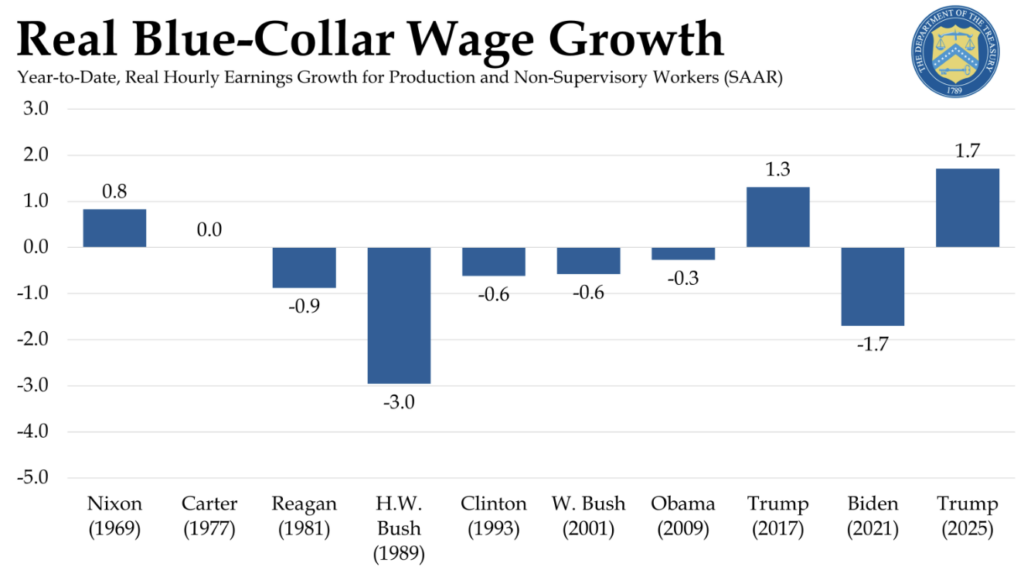

From the two Bush administrations forward through Clinton’s “third way,” past Obama’s destructive policies, America’s employment options narrowed and got worse for the regular people trying to live regular lives (and in the same period real poverty increased markedly as well).

The characteristics of this new American rust-belt society, included the average household debt rates soaring, rising unemployment, the escapism of a significantly increased drug use, and increased suicide rates. Their new found slide into poverty and desperation is causal in increased thefts, petty crimes and violence, increase hate speech of every kind, and random acts of senseless violence. Divorce rates have rocketed sky high while intact families which were the rule, became the exception.

The power elites told us that the lost good paying union jobs would be replaced by the displaced workers getting other jobs in the service industries. In fact those job pay less, are often part time, and clearly are an alternative to what was lost. The official government reported average wage rate stagnated.

Inflation-adjusted stable wage rates is the official government story using their metrics like the consumer price index (CPI) as a measure of “real” inflation. Note the word “Real” in the title of this graph above; that means the numbers are inflation-adjusted using the CPI as the metric of inflation.

According the US Bureau of Labor Statistics (BLS) data:

$1 in 1969 is equivalent in purchasing power to about $8.83 today, an increase of $7.83 over 56 years. Since it is the dollar which is losing value, again according to the BLS, one dollar in 1969 is worth 11 cents in 2025. The dollar had an average inflation rate of 3.97% per year between 1969 and today, producing a cumulative “price increase” of 782.77%.

The non-government biased, objective truth is a much more disturbing story.

How do you get a better metric of inflation?

The price of gold had been relatively stable over centuries. That is why academic historians use it as a objective measure of the value of ancient coins. If one looks at the gold value of the dollar in 1969 and then compares that to the same value in 2024, it shows that the value of the dollar has fallen 50 times.

[The gold price in 1969: $41.10/Troy Ounce. The gold price in mid-December of 2024 was $2,700/Troy ounce. If the value of gold is really a stable thing, which it is, then the value of the $100.00 dollars in 1969 is worth two dollars in 2024!]

What does the gold price of the dollar tell us happened to your money over the same 56 year period of time?

One dollar in 1969 is now worth two cents. That is six times more inflation than the BLS asserts happen over the same time period.

The real, real (objectively inflation adjusted) wage rate was not stable! It has fallen to 1/6th of what it was in 1969.

Think about it. In 1969 the real, real wage rate of the non-globalized average family was sufficient for an average family to be able to support itself with a single worker household, and to be able to buy a home in the suburbs, enjoy a two week vacation every year, buy a new car every three years, to send all of their kids to college (without incurring student debts), and still have a livable retirement program.

Today that so-called “stable wage rate” barely allows a subsistence level existence.

This is the new America of globalism.

Jack Welch, the wealthy CEO of the General Electric Company from 1981 to 2001,famously laid off more than 100,000 people in his first years as CEO. Mr. Welch was nicknamed “Neutron Jack,” as in neutron bomb Jack. The neutron bomb was a theoretical weapon of nuclear warfare that was thought to killed people without destroying much infrastructure. So, it might have been a more lethal, yet less destructive way the wage a nuclear war.

His version of capitalism led him to rampant off-shoring, cashing in stock options, and buying back own shares instead of investing in growth. This help to destroy the American middle class and weakened industry. Financial capital’s interests versus the interests of the real economy on Main Street!

In one sense Jack Welch was the founding father of outsourcing, and he once stated that he would not allow GE to do business with any company that was not aggressively off-shoring its manufacturing. Jack Welch was nowhere near the only “neutron CEO” globalist of his era. He was an outspoken leader, and in many ways he was an archetype for an entire class of globalist CEOs.

The foolhardy knavishness of offshoring manufacturing is clearly supported by the following facts:

Manufacturing only produces 11% of GDP.

Manufacturing is responsible for:

20% of the country’s capital

30% of the nation’s productivity growth

60% of exports

70% of innovation, business growth & development !!!!!!!!!!

Conclusions:

Large transactions involve huge amounts of capital which has become concentrated in the hands of a few. This financier class has become the power-elites of the modern age. They are more powerful than the politicians or the government administrators and executives (or their intelligence agents), who may have the nominal control of thermonuclear weapons, but still find it hard to oppose the Wizards of Oz who work in the many Wall Streets of the world.

“The pen may be more powerful than the sword; but concentrated capital is more powerful than the pen.”

Big money easily influences, persuades or outright bribes government politicians to do its bidding.

These power elite financier types routinely act in shameless self interested ways, yet they pontificate to the masses they control and extort their wealth from in a deeply hypocritical and despicably paternalistic and condescending way through their smartest guy in room megaphones like the United Nations Organizations and World Economic Forum.

- Nine Fundamental Problems or Failures of Capitalism

- 0 – The Zeroth Industrial Revolution

- 1 – What Marx got Right - Factory Labor Exploitation Problem

- 2 – Financial Panics - Walter Bagehot & the Lender of Last Resort

- 3 – Mortgaging the Next Generation – Keynes and Government Deficit Spending

- 4 – The Fallacy of Self Regulating “Free” Markets - Karl Polanyi Speaks Truth to Power

- 6 – Financial Zombies and the Debt Slavery Problem

- 7 – The FED - A Hegelian “Captured Agency” From Birth

- 8 – What Lenin Got Right – The Monopoly Problem

- 9 – Capitalism’s Catastrophe – The Capito-Communist Chinese State Capitalism Problem